How We Help

Your Financial Life Plan

It’s common to think of a financial plan as something designed to just get you to and through retirement. But meanwhile, life is happening: Your children are preparing for college, you’re ready to set a retirement date, and you’re dreaming about travel and other new experiences.

Your financial plan needs to be more than numbers on a page. It should support your life plan, built around the life you want and flexible enough to adapt as it changes.

At Occidental Asset Management, our planning approach creates a financial plan that is designed to grow and adapt with you:

Your plan isn’t a set of disconnected tactics; it’s intentionally designed around your life.

It assumes your life will change and prepares for the need to pivot.

With your plan, your advisor is your navigator, but you are the driver.

To create this plan, we take a complete look at your financial world.

1

Understand

Explore your values, your risk tolerance, and your personal Money Scripts®, the beliefs that shape how you think and feel about money.

2

Analyze

Review your assets, liabilities, cash flow, insurance coverage, tax strategies, and investments to gain a clear picture of where you are today.

3

Plan

Bring these insights together to design your personalized financial plan, ready to evolve as your life does.

Our Approach to Financial Planning

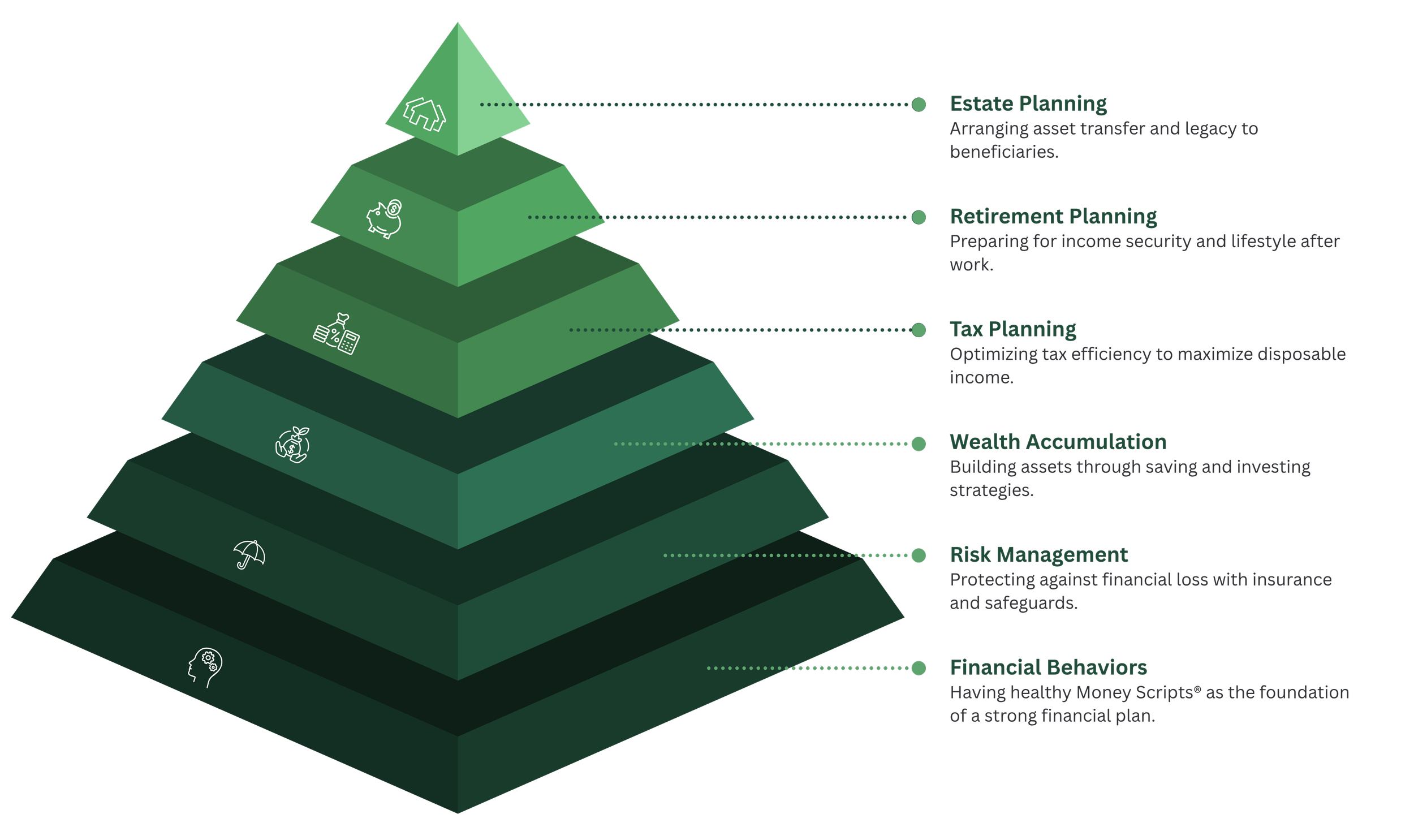

Establishing a solid financial framework is the foundation for achieving your long-term goals. At Occidental Asset Management, we focus on six core principles that work together to create a personalized plan reflecting your unique circumstances and aspirations.

The Financial Planning PyramidThroughout our partnership, we’ll revisit these foundational elements often, adapting and refining your plan as your life evolves. This holistic approach helps ensure your financial framework stays strong and resilient, able to support you through life’s inevitable changes and challenges.

Our Investment Approach Is Defined by Six Guiding Principles

Our investment approach is guided by principles designed to support your financial life plan through every stage of life. We combine disciplined strategies with deep research and ongoing oversight so you can focus on living your life while we focus on managing your wealth.

We seek insights from unbiased studies, which help us identify new methods and opportunities without outside influence.

Because your needs change as your life changes, we build strategies that can flex with you.

Our recommendations are personalized to your goals and best interests.

We look for ways your money can grow while using cost optimization and tax-aware solutions so you pay less.

We spread your investments carefully to help protect your bottom line while they grow.

We strive to use the best tools available to monitor your portfolio and safeguard your financial health.

Financial Psychology

We believe there is nothing more personal than your relationship with money.

After family and personal relationships, it’s one of the most powerful forces shaping your life. That’s why we look beyond the numbers to understand how you think and feel about money, not just what you do with it.

Our firm has a unique focus on the psychology behind effective money management. We don’t just help Clients grow and protect their wealth in their lifetime. We also specialize in working with families committed to building dynastic wealth that lasts for generations. Managing Principal Brad Klontz, Psy.D., CFP®, is a nationally recognized leader in financial psychology and working with dynastic-wealth Clients and families. Dr. Klontz has spent decades researching how beliefs, emotions, and family dynamics drive financial behavior and has helped shape the field of behavioral finance. His work is built into our planning process, and every advisor on our team is trained to apply behavioral finance and financial psychology techniques when appropriate.

Money Scripts®

A key part of this work is uncovering your Money Scripts®, the often-unconscious beliefs about money formed early in life.

These beliefs quietly drive how you spend, save, give, and invest. By identifying and understanding your Money Scripts®, we can see which ones support your financial well-being and which may be holding you back.

This can help you:

Recognize the beliefs and emotions driving your financial decisions

Reduce stress and conflict around money by replacing unhelpful patterns

Build lasting financial habits that support your life and peace of mind

Financial Planning Timeline

Our step-by-step process is designed to give you support at every stage so you can focus on living your life while we help you plan for it.